vermont sales tax exemptions

For example if a consignment shop sells clothing. To learn more see a full list of taxable and tax-exempt items in Vermont.

Printable Vermont Sales Tax Exemption Certificates

A vehicle owned or leased by government.

. Vermont follows the federal IRS designations for tax-exempt nonprofit. Ad Avalara experts provide information to help you stay on top of tax compliance. Exemptions The following is a list of conditions that will allow you to register your vehicle exempt of payment of the Vermont Purchase and Use Tax.

A retailer who sells items on behalf of another consignment must charge tax to the customer on any items subject to Vermont Sales Tax. If you operate or manage a nonprofit you should learn which Vermont taxes apply to you. Machinery EXEMPT Sales of machinery are exempt from the sales tax in Vermont.

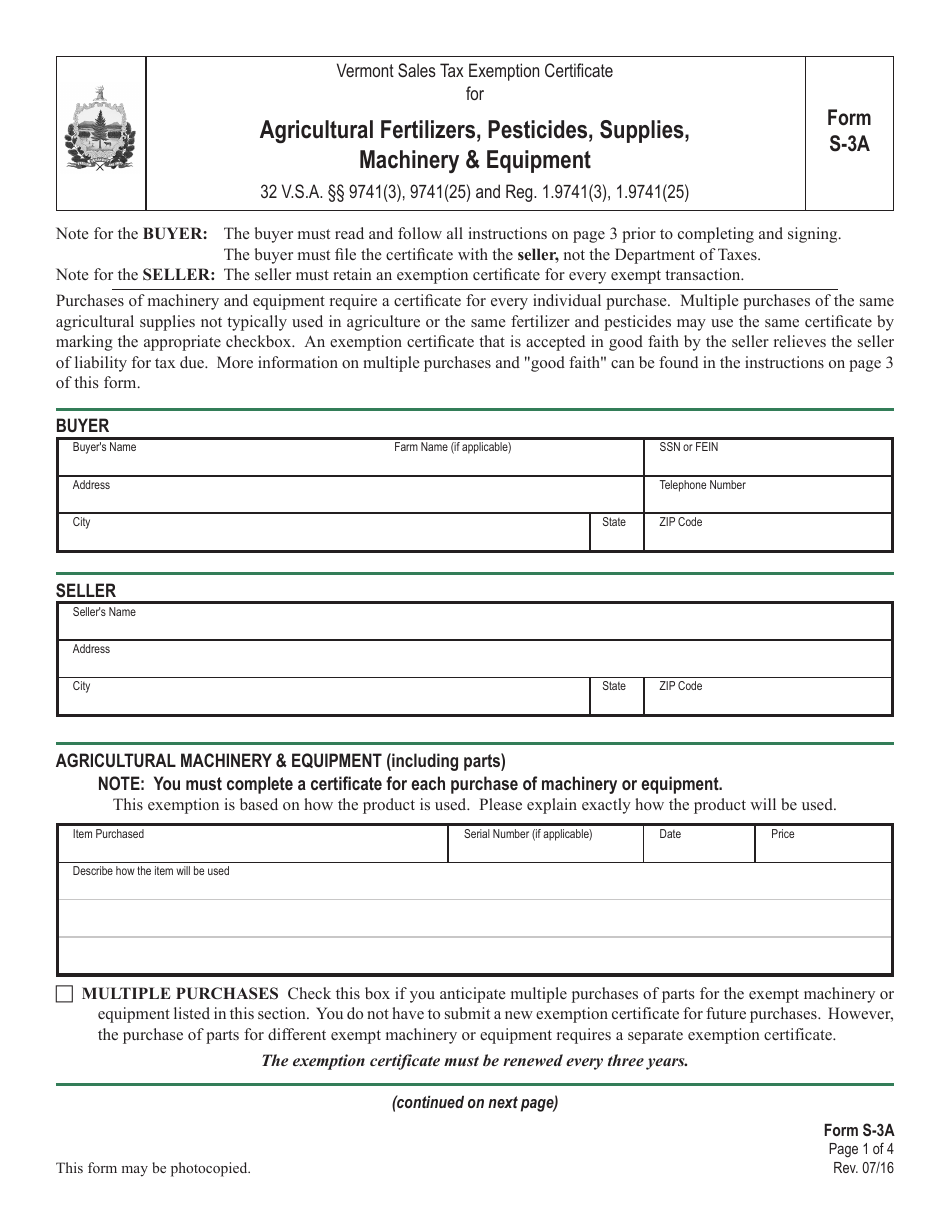

10 rows Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Machinery. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. To learn more see a full list of taxable and tax-exempt items in Vermont.

Including industry updates new tax laws and some long-term effects of recent events. Since sales tax rates may change we advise you to check. Many states have special sales tax rates that apply to the purchase of certain types of goods or fully exempt them from the sales tax altogether.

In general sales tax exemptions are statutory exceptions eliminating the need for the retailer to collect sales tax on a particular transaction or on all transactions with a customer. IN-111 Vermont Income Tax Return. PA-1 Special Power of Attorney.

W-4VT Employees Withholding Allowance Certificate. 974113 with the exception of soft drinks. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

What is Exempt From Sales Tax In Vermont. Including industry updates new tax laws and some long-term effects of recent events. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

Vermonts state-wide sales tax rate is 6 at the time of this articles writing with local option taxes potentially adding on to that. 31 rows Sales Tax Exemptions in Vermont. Sales Use Tax Exemptions by State Present state sales tax exemption certificates to vendors hotels restaurants and other service providers in Vermont and various other states to.

Raw Materials EXEMPT Sales of. Ad Avalara experts provide information to help you stay on top of tax compliance. The sales tax exemption is only intended to be used for inventory that will be resold and not intended for the tax-free purchase of items used in normal business operations such.

Soft drinks are subject to Vermont. Local jurisdictions can impose. Vermont School District Codes.

In Vermont certain items may be exempt from the. It is designed to help businesses determine. The Vermont Department of Taxes has updated its fact sheet on the taxability of agricultural machinery equipment and supplies.

What is exempt from sales taxes in Vermont. Janitorial Services EXEMPT Sales of janitorial services are exempt from the sales tax in Vermont. Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

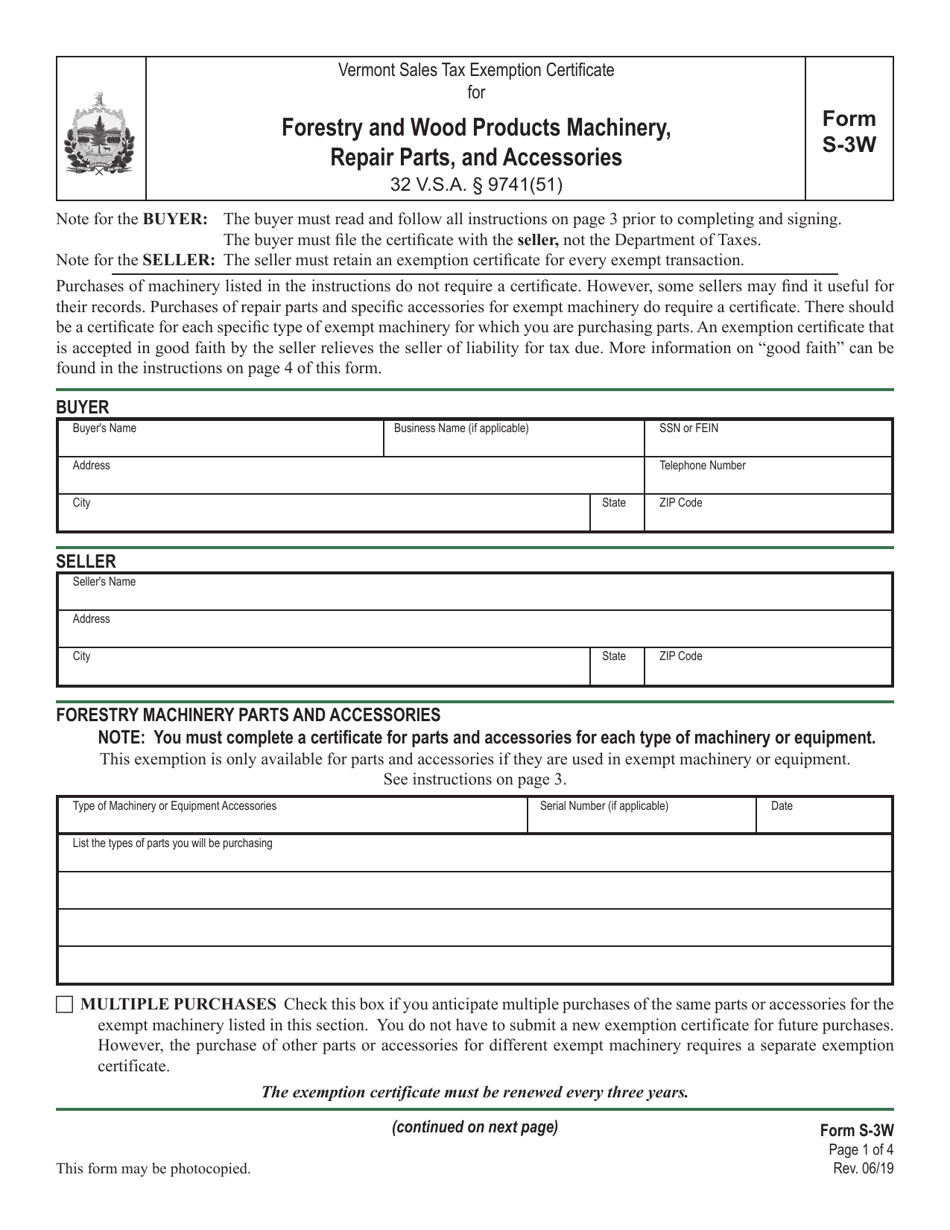

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

State By State Guide To Taxes On Retirees Retirement Tax States

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

Exemptions From The Vermont Sales Tax

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

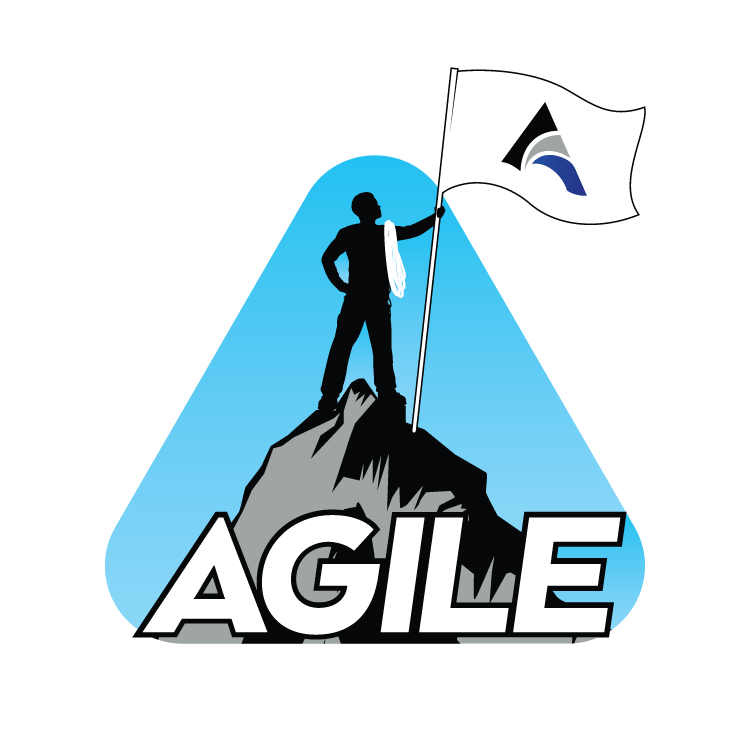

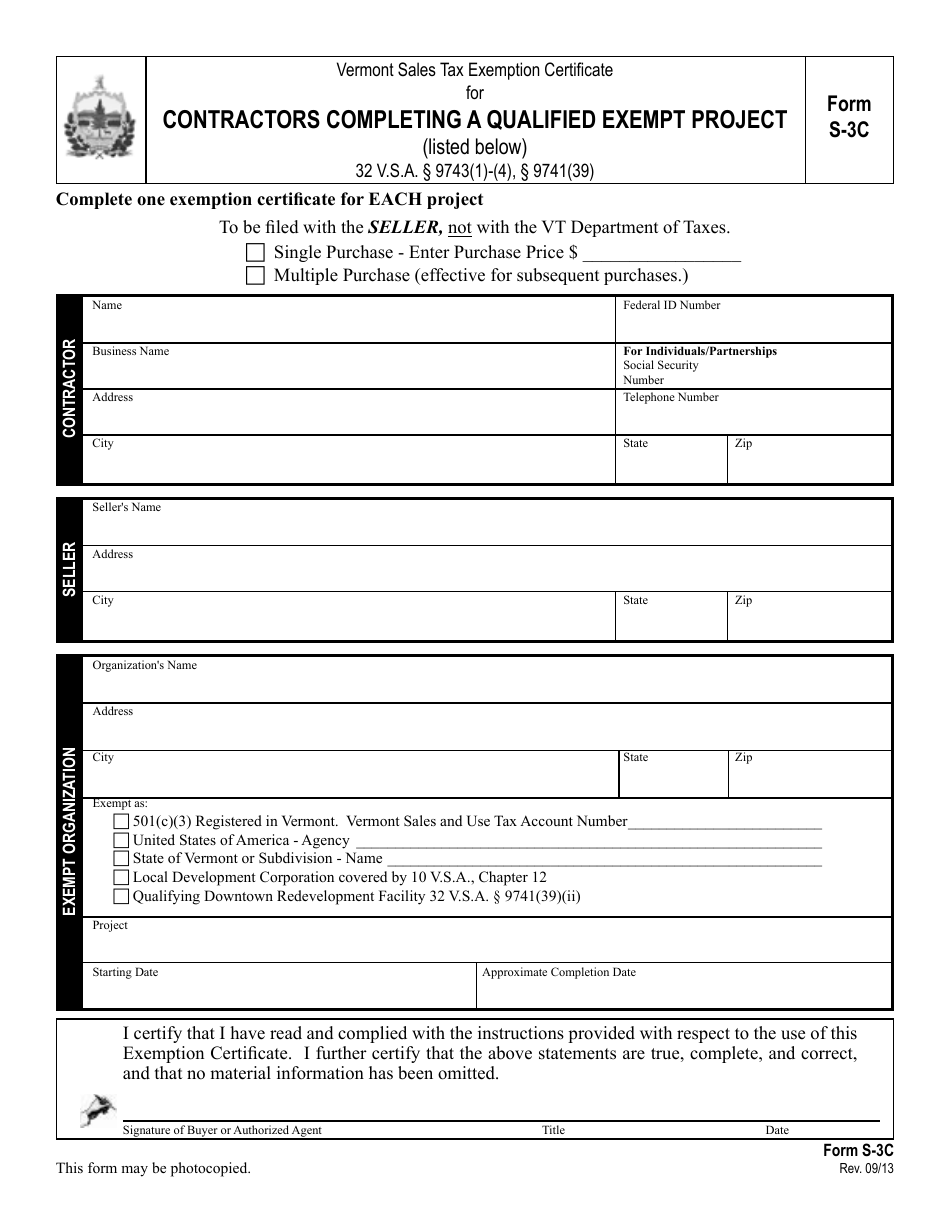

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Form S 3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

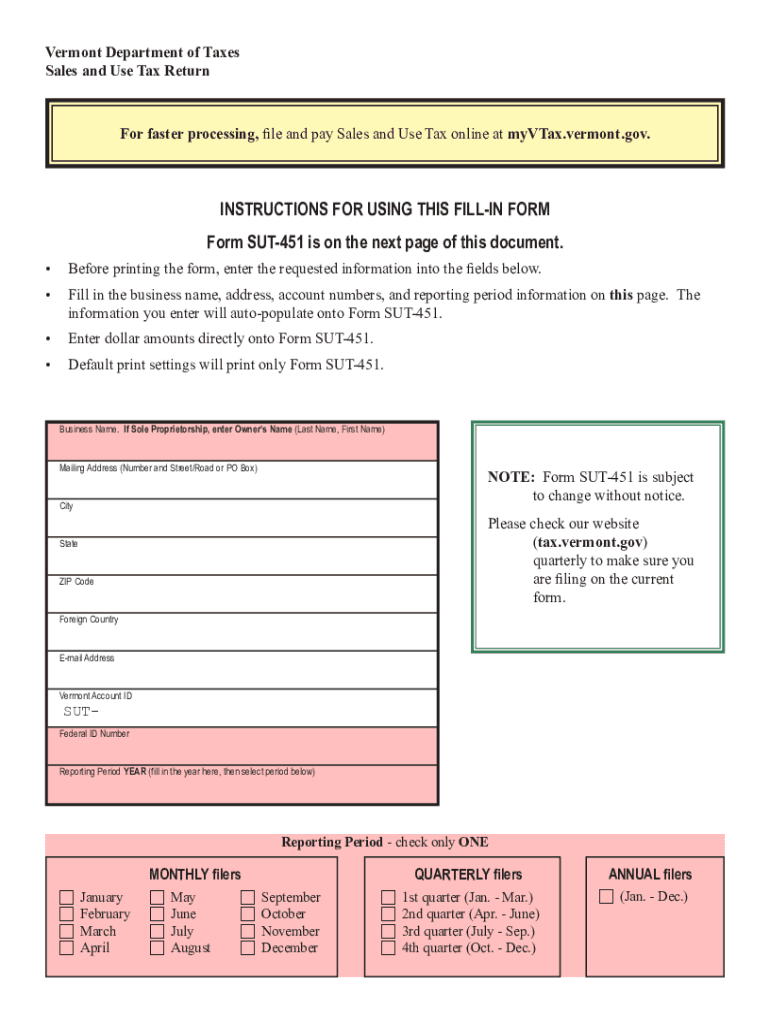

Vt Sut 451 2020 2022 Fill Out Tax Template Online Us Legal Forms